Cash flow is the bread and butter of every business. The inflow and outflow of cash determines nearly every aspect of a company’s health from profitability to growth potential. It is also often the best shock absorber during periods of disruption.

But what happens when inbound payments are interrupted or delayed?

This can have a devastating effect on any business, especially SMEs who are more vulnerable to cash flow challenges. This is particularly true in light of the volatility that has occurred in global supply chains over the past 18 months.

The Wall Street Journal reports that some companies are taking longer to pay their suppliers despite the economy perking up. According to research published by the Hackett Group, U.S. companies took an average of 58 days to pay suppliers during the first quarter of fiscal year 2021 compared to 55 days during the same time period the previous year.

When looking at the complete fiscal year 2020, the number of days jumped to 62 days, up 7.6% year-over-year.

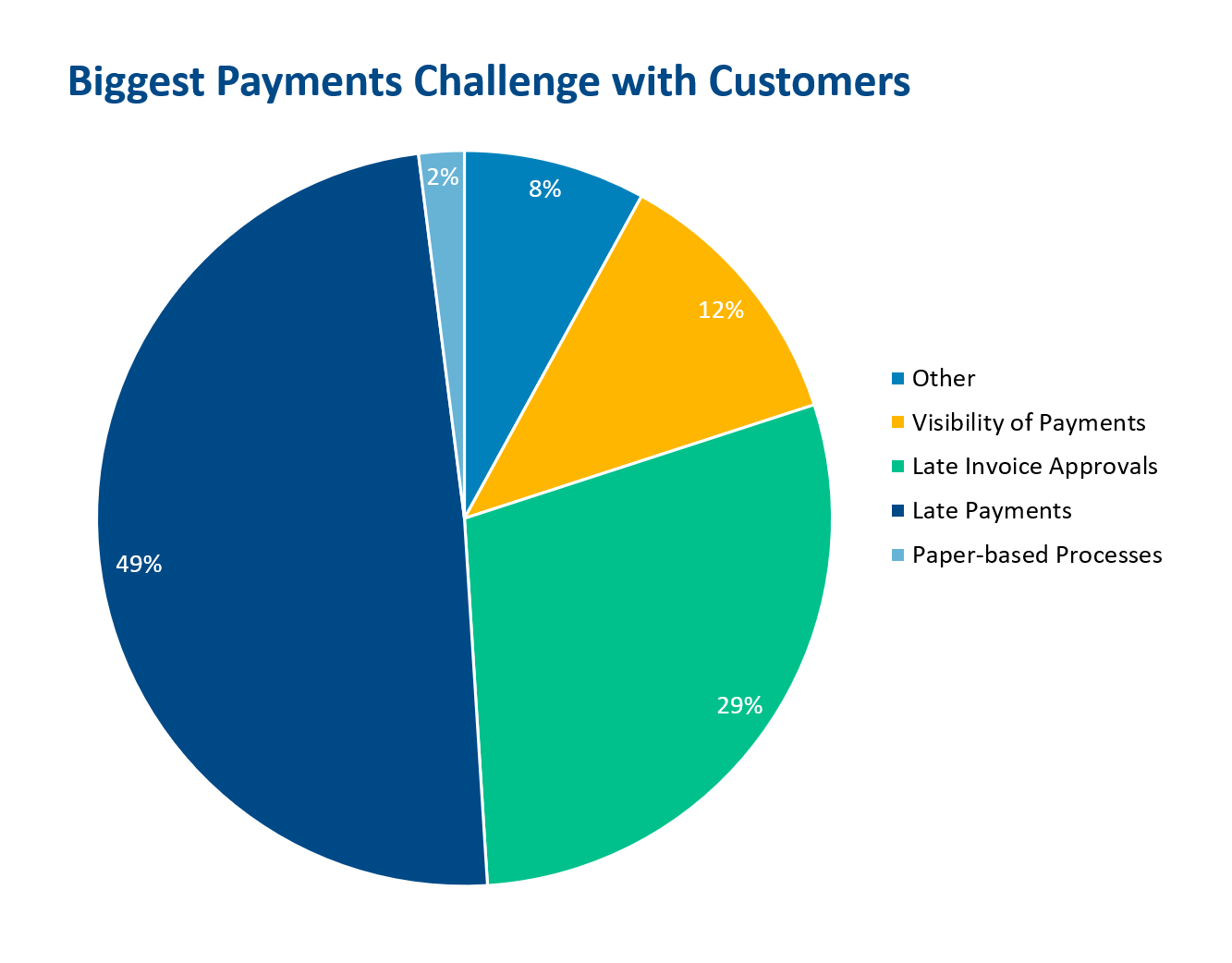

PrimeRevenue’s supplier payment data echoes these findings. In Q1, we surveyed hundreds of suppliers to learn more about their biggest payment challenges. Nearly half reported that late payments were the biggest payment challenge with their customers. Late invoice approvals and visibility into payments were other primary concerns, with 29% and 12% of respondents respectively citing those as their most prominent challenges. Another survey of suppliers found a staggering 60% claimed they had to contact their customers between 1-10 times a month to inquire about payment status. More than 10% of respondents stated they had to reach out more than 10 times a month about payment status. Late payment has always been an issue, but there is newness in the frequency in which it’s happening and the extent to which it’s affecting suppliers. The cash flow squeeze caused by slow payment cycles has caused many suppliers to scale back or shutter operations over the last 18 months. Other businesses that are experiencing surges in demand have watched their expansion projects be stymied by suboptimal cash flow. Many suppliers can no longer afford to ignore just how detrimental late payments are to their business.

Late payment has always been an issue, but there is newness in the frequency in which it’s happening and the extent to which it’s affecting suppliers. The cash flow squeeze caused by slow payment cycles has caused many suppliers to scale back or shutter operations over the last 18 months. Other businesses that are experiencing surges in demand have watched their expansion projects be stymied by suboptimal cash flow. Many suppliers can no longer afford to ignore just how detrimental late payments are to their business.

Leveraging Technology-led Solutions to Drive Businesses Forward

The increasing scope of late payments is a serious threat to supply chain health and stability, particularly for suppliers. This has caused us to look at our role in solving this problem with a fresh perspective. How can we leverage our technology to ensure suppliers receive timely payment? How can we help suppliers accelerate cash flow? How can we broaden our solution portfolio to tackle these challenges?

Late payment is a broad issue that requires multiple solutions, and it is important to highlight the role technology will play in solving the full scope of the problem. Technology-led early payment solutions are one approach. Examples include supply chain finance (also known as reverse factoring or supplier finance), dynamic discounting and accounts receivable finance, all of which give suppliers the flexibility to accelerate payment on their invoices.

Another option is implementing a solution that automates digital payment throughout the supply chain – otherwise known as a “maturing payment solution.” This allows a buyer to streamline payments, which reduces administrative burden and eliminates the risk of paying a supplier late. For suppliers, this solution provides increased visibility into invoice approvals and upcoming payment as well as enhanced control and improved cash flow.

PrimeRevenue’s Impact

PrimeRevenue’s technology excels at connecting the supply chain through reliable, transparent, and timely payment. As soon as invoices are approved, they are automatically uploaded to the system via ERP integration and available for early payment. Not only does this automated upload expedite the buyer’s AP process, it also provides faster access to invoice visibility and the ability to advance payment for suppliers.

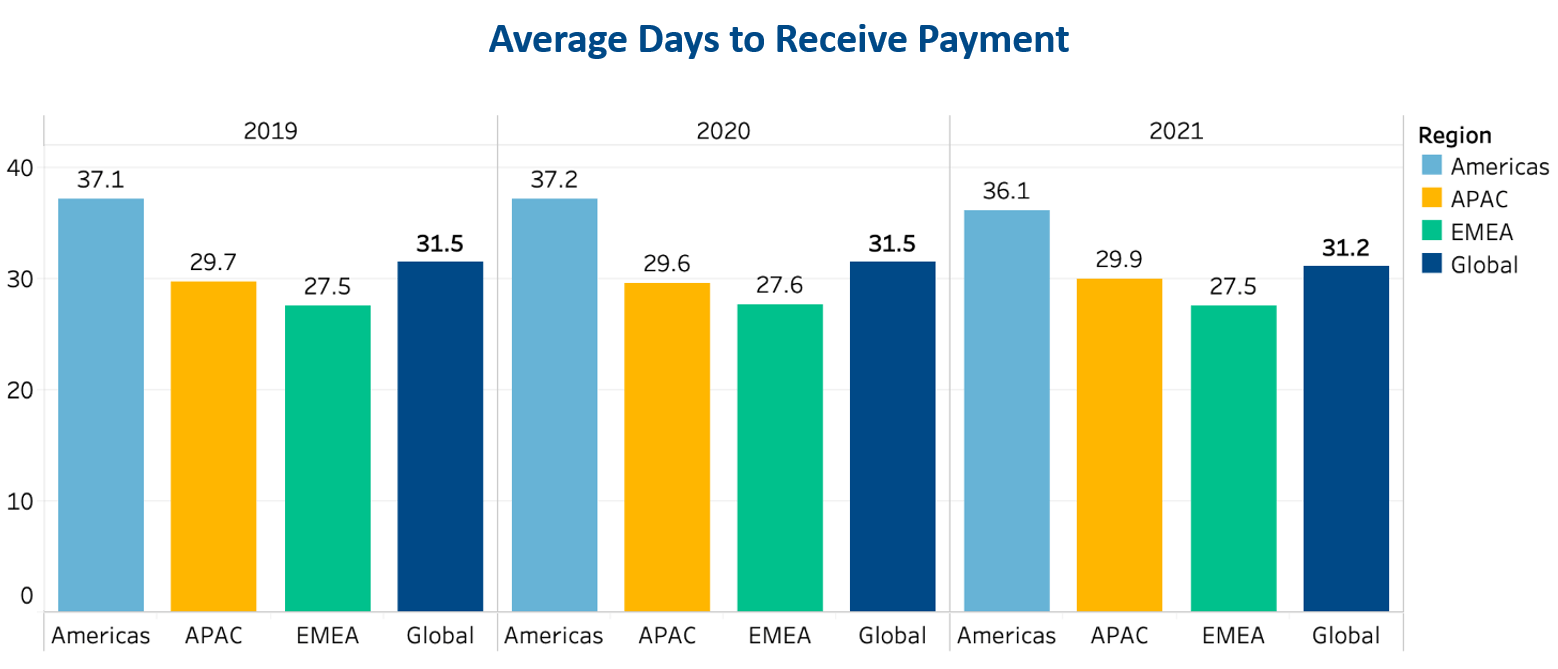

To date this year, suppliers across all regions on PrimeRevenue’s platform get paid an average of 31.2 days after invoice date. In the U.S. specifically, supplier payment was received on an average of day 36.1. This is nearly twice as fast as suppliers without access to an early payment option like supply chain finance or dynamic discounting per the Hackett Group’s data.

Average days to receive payment has held steady over the past couple of years – and in some cases has decreased, signaling faster payment. Despite access to government subsidies and assistance throughout the pandemic, suppliers continued to advance payment at the same rate in 2020 as they did in the previous year. This is particularly telling of the value suppliers receive from early payment because it shows they continued to use an early payment solution despite having additional cash source.

Suppliers receiving timely payments via the PrimeRevenue platform have used the cash to fuel incredible transformations within their businesses.

“In my 16 years in the commercial logistics industry – several of them on the owner/operator side – I’ve come to understand firsthand how early payment can provide a precious financial advantage to a growing company,” said Alex Lomas, Director of Reformation Logistics, a supplier to DFDS. “But in the last year, that understanding took on new meaning as my business partners and I did the unthinkable. We launched a business during a pandemic. And it wouldn’t have been possible without [payment via] PrimeRevenue.”

While there is still work to be done to solve the problem of late payments, PrimeRevenue is pioneering new solutions that are innovating the global B2B payments space. Our TEAM is dedicated to accelerating global commerce by streamlining B2B payments – and there are more solutions to come.