Is Short-Term Financial Resiliency Possible with a Strong and Swift Response to COVID-19?

With a TEAM in Hong Kong and thousands of suppliers in the Asia-Pacific region, PrimeRevenue has closely monitored COVID-19 and its impact since the beginning of the year. We have seen the toll it has taken on both an economic and human level as the world crisis continues.

To better understand the potential impact of the coronavirus, I asked a TEAM of PrimeRevenue business analysts to examine our data and help model what we can expect to see moving forward.

What we found is this: while many are still deep in the throes of COVID-19, those that were first affected are finally seeing a light at the end of the tunnel.

The economy has bounced back from every economic downturn in the past – and history tends to repeat itself. In fact, our data indicates that Chinese businesses are already beginning to ramp back up to pre-COVID-19 levels, although we recognize that “normal” is beyond the horizon. I’d also caution that this is still early data, and whether or not a recovery is real or sustainable is something we are watching for on a daily basis.

What Data Do We Have?

PrimeRevenue has insight into thousands of companies’ invoices across the globe through our supply chain finance platform. When a company (a buyer) purchases goods such as toilet paper from their supplier, the supplier makes that toilet paper, fulfills the order and sends the goods along with an invoice. When the buyer receives the goods, the company approves the invoice before issuing payment.

Once the invoice is approved, our platform automatically receives the invoice (we call this process “invoice uploads”). The volume of invoice uploads is an indicator of trade transactions – if the overall value of invoices is growing, trade between buyers and suppliers is growing. Similarly, if volume is down, trade is down.

This is where we come in. When an approved invoice makes it onto the PrimeRevenue platform, the supplier can see and choose when to get paid for the invoice. Not only does this provide insight into the status of accounts receivable, it also gives suppliers access to critical cash flow because they can opt to receive early payment by selling approved invoices to a funding institution in exchange for a small, annualized fee.

That’s an example of just one transaction on our platform. In reality, we process millions of invoices and tens of billions of dollars per month, which gives us access to data that provides a benchmark for standard business activity and allows us to look for abnormalities in trading patterns.

What We’ve Seen

It’s important to note that every year, most businesses in China close for 1-2 weeks to allow employees to celebrate Chinese Lunar New Year. The holiday falls on a different date each year, but this year fell on January 25.

Normal business patterns in China show an annual reduction in invoice uploads during this time as employees visit family and enjoy the Lunar New Year festivities. Since fewer goods are shipped, fewer invoices are sent, and thus invoice upload volumes decrease. Once employees return and production comes back online, we see invoice volumes rise and eventually return to normal levels – typically within several days to a week.

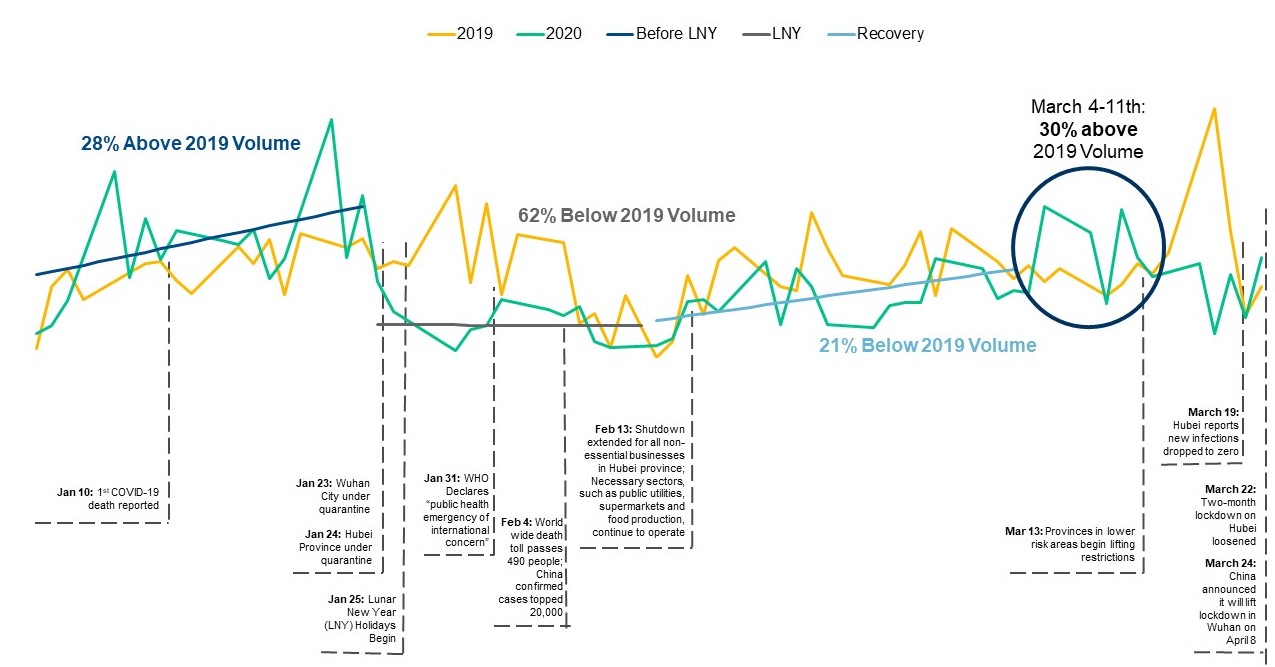

PrimeRevenue analyzed the amount our suppliers in China were charging buyers for goods between January 1 and March 20 in 2019 and 2020:

As visualized in the chart above, 2020’s Lunar New Year was on January 25 (2019’s was on February 5th), which is when we expected to see the usual drop in invoice volume related to the holiday. Prior to the holiday, we were seeing a 28% increase in the value of goods suppliers were selling over the same period in 2019 – showing us the year was off to a great start for these companies in China.

After Wuhan and Hubei provinces were placed under quarantine and the Lunar New Year began (between January 23-25), 2020 invoice amount volume dropped to 62% below 2019 levels. Some of this drop would correlate to the annual holiday dip we see every year, which typically lasts for 5-7 days. However, this year’s slump, correlated to the holiday and the outbreak, lasted between January 21 and February 13, or 23 days.

Then we saw a come-back period between February 14-26, when volume improved to be just 21% below 2019. By February 26, we began to see a trend toward normal behavior. Between March 4th and March 11th, invoice amounts outpaced 2019 by 30%, likely correlated to restrictions being lifted in some of the regions within China.

On March 24, Chinese officials lifted restrictions on the Hubei province. Wuhan is expected to follow suit within the next two weeks. We will be watching our data closely to see if these restrictions result in more improvement, or if the global crisis occurring now takes effect because demand is plummeting as many countries lock down their economies.

What Does This Mean?

At a time where there is precious little positive media, this may be a small ray of hope at the end of the tunnel. The fact that we’re seeing an increase in volume on our platform in China means that suppliers are shipping goods and trade is being transacted in the first country affected by COVID-19. Our preliminary data suggests economic downtime could last only 4-6 weeks if other countries follow China’s aggressive strategy of shutting down to contain the virus. It will be important to see how China’s containment efforts last as China comes back online. We will keep our eye on this over the coming month.

Our statistics are meaningful, but only represent a relatively small percentage of China’s overall GDP. However, our data can be an indicator of broader market dynamics in China.

Ultimately, it’s too soon to tell what the long-term impact will be from the coronavirus. We will continue to monitor the data and report on major shifts we see. One thing we do know, however, is that it’s more important than ever to take health seriously and come together as a community.

Sharing data like this can hopefully help many in the business community educate themselves to make better decisions. We all must make decisions too fast with imperfect data, and every bit helps. Looking out for one another, both personally and professionally, is the only way we’ll come out of this crisis stronger than ever.

Stay safe, strong and healthy everyone.